PayPal Resolution Center: What it is and how you can easily resolve issues

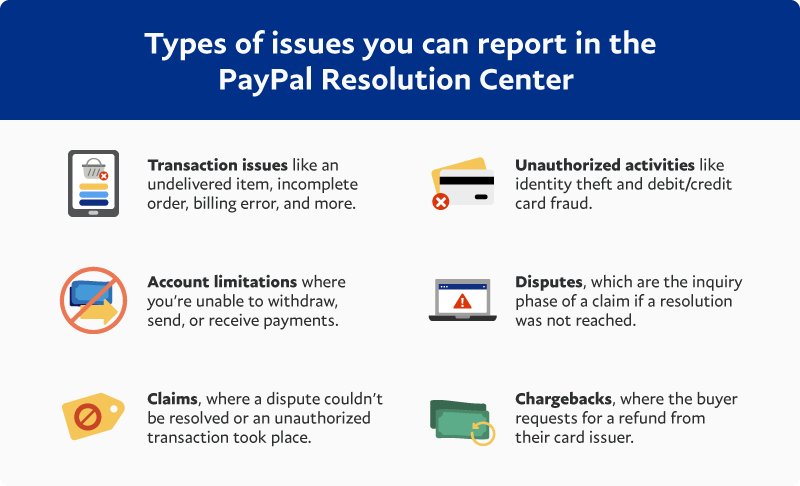

Find out how you can leverage PayPal Resolution Center to report and resolve account and transactional issues.

Running a business is not always smooth-sailing. That’s why PayPal Resolution Center is the place for you to easily view, manage, and resolve any type of case that arises. Keep reading to discover its primary functions and how managing disputes and other issues can be a more efficient process.

What is the PayPal Resolution Center?

The PayPal Resolution Center is a single dashboard within your PayPal account where sellers and buyers from around the world can easily connect and resolve issues associated with their account or transactions. You can also request for PayPal to investigate a potential payment problem.

How does the PayPal Resolution Center work?

Whether your account has been temporarily restricted or a customer has filed a dispute against you, the PayPal Resolution Center allows you to review the details of why the issue has taken place. It’s also where you’ll find helpful prompts from PayPal on your next steps to solve the issue. For instance, the response times, or a request to provide more information or evidence to support your case.

Connect with customers to resolve transaction issues together

When a customer faces an issue with their order, they can first bring it to your attention by reporting it in the Resolution Center. This is when the seller can directly communicate with the buyer to figure out what happened and work together to come to an agreeable solution. As a seller, this is a great opportunity for you to offer a solution that will satisfy your customer—such as a refund if the item is damaged or no longer in stock, or a product replacement if the wrong item was sent. This also helps avoid the hassle of a dispute, which the buyer can file if they’re not happy with the solution you provide.

Read more about preventing cases and transaction issues here.

Report unauthorized activities to safeguard your business

Notice any suspicious activity such as an unauthorized transaction or login? Reporting it in the Resolution Center can help you protect your business and customer data while PayPal investigates the matter. This also reduces your chances of being subjected to fraud attempts or worse, costly claims and chargeback fees that may hinder your business growth.

Read more about the best practices to prevent online fraud here.

Lift account limitations and regain access to your funds

When your account is limited, you won’t be able to perform certain actions like withdrawing or sending money. This can be frustrating, but you can use the Resolution Center to remove the limitation so you can access your funds quicker and continue running your business. Apart from that, you’ll understand better why the limitation was placed in the first place, which could be due to reasons such as unauthorized usage, a high number of claims, and more. This in turn, can help you address the reasons causing the limitations accordingly and prevent them from happening in the future.

Read more about account limitations and restrictions here.

Resolve disputes before they escalate into a claim

If an issue isn’t resolved between buyer and seller, a dispute may be raised. When this happens, PayPal will place a temporary hold on the transaction funds until the dispute is resolved. In other words, you won’t immediately lose your eligible funds and you’ll have 20 days1 to respond. Rest assured, you’ll be notified via email once a dispute has been opened, and we’ll guide you through the response process. Once a decision is reached, the funds will either be released to you or refunded to the buyer.

Read more about responding to disputes here.

Get covered for a claim even if it’s decided in the buyer’s favor

When a dispute cannot be resolved, it is escalated to a claim and PayPal has the authority to review and determine the outcome. The resolution timeline is extended and you have up to 10 additional days2 to respond. What’s more, we’ll help you work towards an outcome by asking you to provide evidence such as a shipping receipt, signature confirmation, or others.

And even if the outcome is decided in the buyer’s favor, the decision could still be reversed. You’ll have an additional 10 days2 to appeal the outcome of the claim and provide new information. If your appeal is successfully granted, we’ll reimburse you the eligible funds.

Read more about resolving and appealing claims here.

Prevent chargebacks to protect your sale

A chargeback is when the customer requests their card issuer to reverse or cancel a completed transaction. More often than not, this causes the seller to be subjected to penalties—but with the help of the Resolution Center, your sales are not completely lost. That’s because we’ll request for evidence from you and you’ll have 10 days2 to respond. Then, our team of chargeback protection specialists will help you build a case to take to the card issuer. An additional benefit is that even if you lose the chargeback, we’ll cover your loss if the transaction meets our eligibility criteria.3

Read more about preventing chargebacks here.

Although account issues and disputes are part of doing business, you can rest assured knowing that you can always get help from PayPal Resolution Center. More importantly, we’ll help you resolve buyer cases with ease so you can avoid costly claims and chargebacks from affecting your bottom line.

1 Timeline is subject to change. The buyer or seller may choose to escalate the dispute to a claim earlier rather than wait 20 days. If there is no response after 20 days, the case will be closed.

2 Timeline may vary by financial institution.

3 Available on eligible purchases. Limitations apply.

We’ll use cookies to improve and customize your experience if you continue to browse. Is it OK if we also use cookies to show you personalized ads? Learn more and manage your cookies