Get paid for your freelance services with PayPal

How to get paid quicker as a freelancer with PayPal

Learn how easy it is to get paid for your freelancing work with PayPal

How to get paid

#1 Always have a contract

Ensure that there is a legally-binding contract before a project starts. Don’t be shy to propose one if your client doesn’t, even if it’s a project commissioned by personal friends. The contract should at minimum cover bases like payment terms, late fees, copyrights, indemnity and non-disclosure clauses. The same template may not work across all legislations, so it’s important that you review every contract with due diligence.

Don’t be afraid to negotiate. Payment policies differ for different businesses, including yours. Know your position and include tactical clauses that respect your own deadlines.

#2 Invoice like a pro

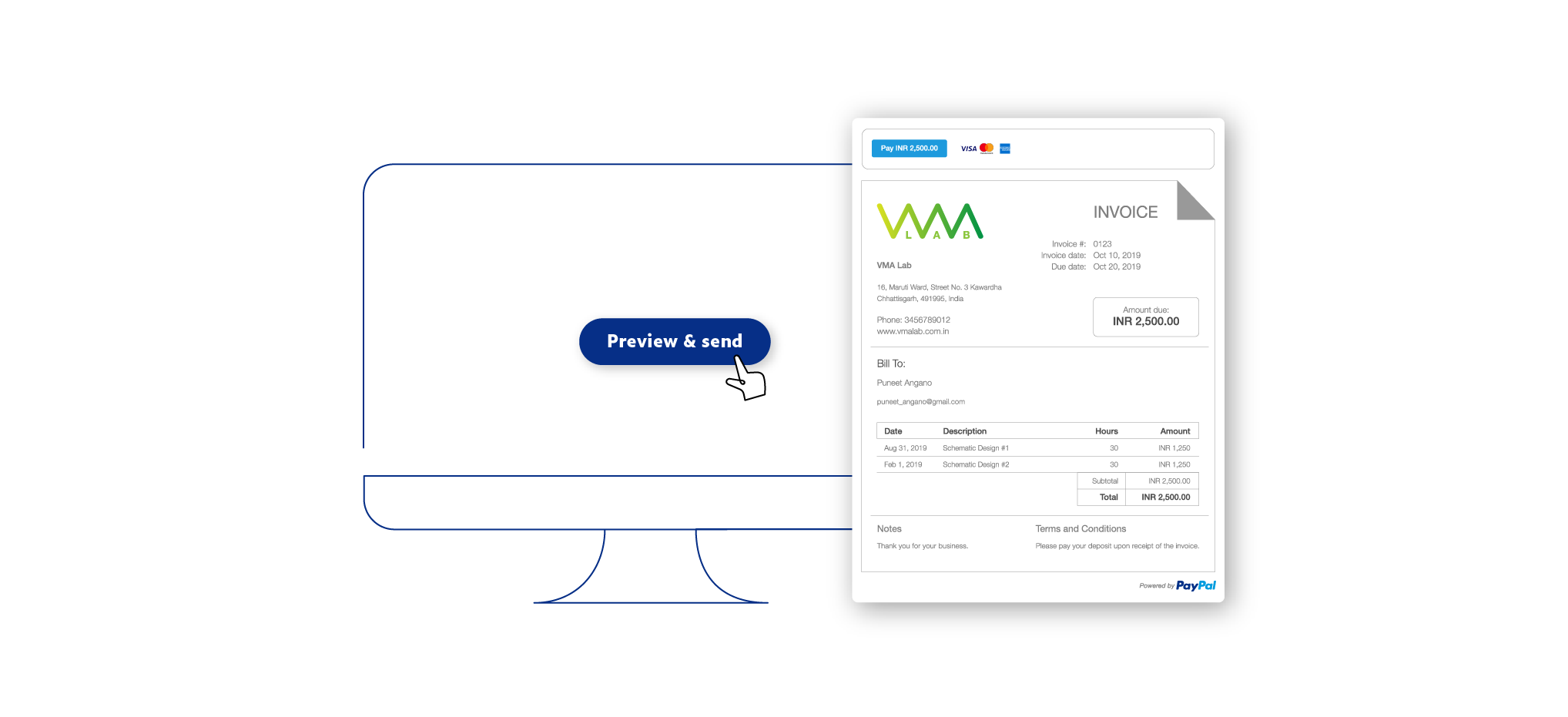

Send prompt invoices. Revise payment terms and previous negotiations in your communications, and ensure your invoice contains all the necessary details, such as company name, bank details, and terms and conditions. PayPal eases the process of creating one by offering customisable templates you can use and send immediately.

Remember, it pays to be polite. A simple “please” and “thank you” can not only get you paid faster, but is good for your brand and image.

Remember, it pays to be polite. A simple “please” and “thank you” can not only get you paid faster, but is good for your brand and image.

Try it out for yourself. Use our free Invoice Template Generator tool to create and customise an invoice immediately.

#3 Make it easy for clients to pay.

Giving your clients payment options they are familiar with can be key to getting paid fast. Instead of only providing bank transfers, which may prove troublesome for overseas clients, offer a solution that gives them the ability to pay through credit or debit card, and PayPal. Focus on removing potential barriers to getting paid by offering convenience and security. Using a globally-recognised brand like PayPal can also help build trust in your business.

Your client can pay immediately when you send an invoice through PayPal. All they need is to click on the “Pay Now” button. He or she can then choose pay through PayPal, or credit or debit card. Payments will be reflected in your account within the day.

Want to know more? Read ourguide on online invoicing.

#4 Follow Up

Don’t hesitate to send follow-ups if your invoice isn’t paid on time. Even the most reliable clients can forget the occasional invoices. Be firm and polite, but don’t be afraid to change your tone when needed. Focus on finding a solution in these situations while keeping professional.

#5 Stay organised.

Unfortunately, the work doesn’t stop after you get paid. Keeping your invoices consistently organised is essential, whether for budgeting, keeping track of projects, or filing for tax.

To save yourself time and trouble, it’s worth automating as much of the process as you can, from creating and sending the invoice, tracking payments, and scheduling recurring invoices for retainer clients. Better still, have access to these tools from one dashboard on mobile or desktop. This means you can stay on top of your finances even on-the-go.

In summary:

Always have a contract.

Invoice promptly.

Make it easy for your clients to pay.

Stay professional, polite, and firm.

Keep your finances and invoices organised

Automate as much of the process as possible.

Check out more ways you can pay with PayPal:

| PayPal.Me | Online Invoicing |

| A fast and simple way for you to get paid, without the hassle of setting up a bank transfer. All you need to do is set up your personalised PayPal.Me link, and share it via an email, a text message, a chat or even your business card. Anyone with a PayPal account can pay you. | Send professional invoices without the need to pay or spend hours creating one. Create, send, and schedule invoices within minutes with PayPal’s Online Invoicing. All your invoices are recorded and tracked in your PayPal account, so you can be on top of your finances better and easier. |

| Start now | Start now |

If you accept cookies, we'll use them to improve and customise your experience and enable our partners to show you personalised PayPal ads when you visit other sites. Manage cookies and learn more